Diamond Education

Diamond Prices

The science and economics of diamond pricing is a complex interplay of numerous factors. To the uninitiated, the cost of a diamond might seem to be simply a matter of size or sparkle. Yet, beneath the surface brilliance lies a rigorous methodology that assesses value based on characteristics both seen and unseen. As a quintessential gemstone used for adornment, investment, and even industrial applications, understanding the true value of a diamond is an educational journey.

While many are familiar with the term 'carat', there's a world of knowledge encompassed within the intricate grids of the Rapaport diamond report and other pricing mechanisms. This guide is designed to be a comprehensive dive into the multifaceted realm of diamond pricing. From the foundational understanding of price per carat to discerning the nuances of alternative valuation metrics beyond the popular Rap list, our aim is to provide readers with a robust and educational overview of the diamond industry's valuation standards.

Summary:

- Calculating Diamond Price Per Carat

- Rapaport Diamond Report

- Diamond Pricing Alternatives to the Rap List

- How to Save Money When Buying a Diamond

Diamond Price Chart (Round Brilliant)

| Diamond Carat Weight | Price | Diamond Example |

|---|---|---|

| 0.50 carat | $500-$3,500 | Click here |

| 0.75 carat | $1,500-$5,000 | Click here |

| 1.0 carat | $1,800-$17,000 | Click here |

| 1.5 carat | $3,500-$34,000 | Click here |

| 2 carat | $8,500-$60,000 | Click here |

| 2.5 carat | $8,800-$75,500 | Click here |

| 3 carat | $17,000-$140,000 | Click here |

| 4 carat | $28,000- $222,000 | Click here |

| 5 carat | $43,500-$287,000 | Click here |

*Prices updated July 2024

What is a 'Carat'?

Definition: A carat is a unit of weight for diamonds and other gemstones. One carat is equivalent to 200 milligrams.

Origins: Historically, the term originated from carob seeds, which were used as a standard of measuring precious gemstones due to their uniform weight.

Image Courtesy: Whiteflash

Now, let's move to the core factors that play a pivotal role in diamond pricing:

The Four Cs and Pricing:

Cut: Refers to how a diamond is shaped and faceted. The quality of a cut can significantly influence price.

- Brilliant, princess, and oval are popular cut types.

Color: Diamonds are graded based on their color, from colorless to yellow/brown.

- D is colorless (highest grade) while Z has noticeable color.

Clarity: Measures the diamond's internal and external imperfections.

- Flawless diamonds have no inclusions, while those graded I3 have visible inclusions.

Carat Weight: As the weight increases, so does the price. However, price doesn't scale linearly with weight.

Price Jumps at Thresholds:

Diamond prices tend to see notable increases at half-carat and whole carat points.

For example, a 0.95-carat diamond could be significantly less expensive than a 1.00-carat diamond, despite a minimal visual difference. An 0.89 (also known as an 89 pointer) can be a great option. Make sure to focus on cut quality, as this can make the diamond appear larger because of the edge to edge light return.

Rapaport Diamond Report

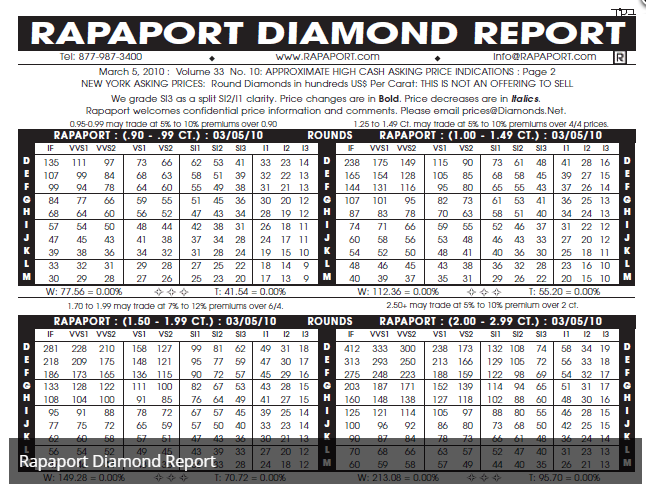

The Rapaport Diamond Report, often simply referred to as the "Rap Sheet," is a foundational tool within the diamond trade, providing weekly price sheets for diamonds based on their carat, clarity, color, and cut. Here's a skimmable breakdown:

Introduction to the Rapaport Report:

- Definition: A weekly published price list for diamonds, used globally as a primary pricing benchmark.

- Origins: Introduced by Martin Rapaport in the 1970s, it revolutionized the diamond industry by providing a standardized pricing system.

How to Read the Rapaport Report:

- Grid Layout: The report is organized as a grid, with columns representing diamond color and rows denoting clarity.

- Pricing: Each cell within the grid provides the per-carat price for diamonds of that specific color and clarity combination.

- Discounts/Premiums: Often, traders use the Rap Sheet as a baseline, offering discounts or premiums based on other factors like fluorescence, shape, or source of the diamond.

Rapaport Diamond Report

Limitations of the Rapaport Report:

- Not Absolute: It's a guide, not a mandate. Actual transaction prices can differ based on several factors.

- Excludes Other Factors: The report doesn't account for cut quality, fluorescence, or specific geographic market trends.

- Supply-Demand Dynamics: Prices on the Rap Sheet might not always reflect current supply and demand trends, especially in rapidly changing markets.

The Rapaport Diamond Report remains a pivotal resource in the diamond industry, offering a consistent benchmark for traders worldwide. However, as with any tool, its efficacy is augmented when complemented with comprehensive market knowledge and real-world trading insights.

Diamond Pricing Alternatives to the Rap List

While the Rapaport Diamond Report remains an industry staple, several other pricing benchmarks and mechanisms have emerged over the years. These alternatives offer varying perspectives and methodologies in diamond valuation. Here's a succinct overview:

IDEX (International Diamond Exchange)

Definition: A global online platform offering real-time diamond trading and pricing information.

Key Feature: Boasts real-time pricing, making it dynamic and responsive to immediate market shifts.

Advantages over Rapaport:

Real-Time Data: Offers instant price updates, reflecting current market conditions.

Global Coverage: Captures data from various global markets, enhancing its comprehensiveness.

Limitations:

Subscription-Based: Access to full features requires a subscription, unlike the Rapaport which is often more accessible.

Variability: Since prices are updated in real-time, they can fluctuate frequently, which might be confusing for some users.

Diamond Retail Benchmark (DRB)

Definition: A pricing tool that focuses on retail diamond prices, giving consumers a clearer idea of market trends.

Key Feature: Uses big data analytics to provide transparent pricing metrics for consumers.

Advantages:

Retail Focus: Directly relevant for consumers, offering insights into retail market trends.

Data-Driven: Bases its metrics on vast amounts of retail data, making it a robust tool.

Limitations:

Less Relevant for Traders: As it’s geared towards consumers, it might not be as useful for industry insiders.

Availability: Access to comprehensive data might be limited or require payment.

More Alternatives:

PolishedPrices: Offers an independent, global benchmark for polished diamond prices.

Gemval: Provides online valuation and appraisal services, useful for a variety of gemstones, including diamonds.

Limitations:

Specificity: Each has its niche and might not be as comprehensive as the Rapaport or IDEX.

How to Save Money When Buying a Diamond

Navigating the sparkling world of diamonds can be overwhelming, especially when seeking value for money. Below are some actionable tips and insights to maximize your investment:

Prioritize the Four Cs:

Determine What Matters: Not everyone needs a colorless, flawless diamond. Determine which of the Four Cs matters most to you and which you can compromise on.

Cut Over Carat: Often, a well-cut diamond will appear larger than its carat size suggests due to its brilliance and sparkle.

Strategic Weight Purchases:

Threshold Savings: Consider buying just under weight thresholds, like 0.90 carats instead of a full 1.0, for significant savings with minimal visual difference.

Settings and Designs:

Masking Imperfections: A smart setting can hide inclusions or highlight a diamond's best features. For example, bezel settings can cover edge flaws.

Certification and Verification:

Ensure Authenticity: Always opt for diamonds certified by reputable labs. This ensures you're getting the quality you're paying for. For natural diamonds only buy GIA certified diamonds and for lab stick with the IGI or GIA.

Digital and Direct Buying:

Online Retailers: With lower overhead costs, online platforms can offer competitive prices. Always ensure they have a good return policy, trade up guarantees and search for reviews on Google and Yelp.

Lab-Grown Diamonds:

Economical and Ethical: Lab-grown diamonds can be 70-80% cheaper than their natural counterparts. They're also sustainable and conflict-free.

Nearly Identical: To the naked eye, and even under magnification, lab-grown diamonds are virtually indistinguishable from natural diamonds.

The allure of diamonds, whether they're sparkling atop an engagement ring or as part of an investment portfolio, is undeniable. Yet, understanding their value requires diving into the depths of industry standards, tools, and metrics. From the renowned Rapaport Diamond Report to emerging tools like IDEX and DRB, the landscape of diamond valuation is rich and varied. As consumers, leveraging this knowledge—be it considering lab-grown diamonds or strategically selecting the Four Cs—can lead to significant savings and heightened satisfaction. In the radiant world of diamonds, knowledge truly is as valuable as the gemstones themselves.